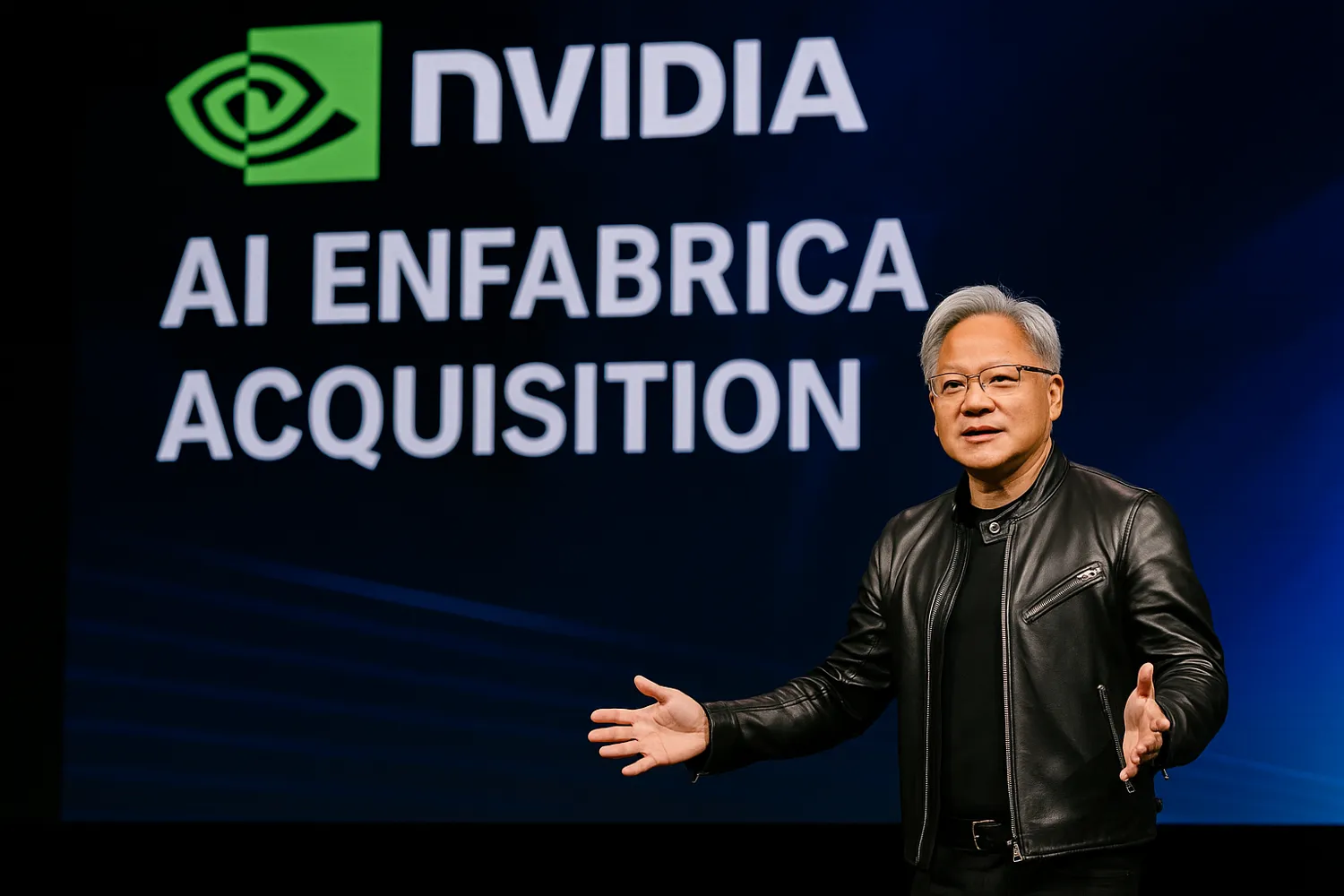

The Nvidia Enfabrica acquisition is not just another tech deal. It is a $900 million statement that the GPU giant is willing to buy leadership and license hardware technology at any cost. Mainstream reports frame this as an exciting push into AI networking, but the deeper truth is more troubling: Nvidia is consolidating control, stifling competition, and transforming AI into an exclusive empire.

Context: the mainstream narrative

According to CNBC, Nvidia agreed to pay over $900 million to hire Enfabrica’s CEO and license its advanced networking technology. Enfabrica, a Silicon Valley startup focused on AI infrastructure and memory bandwidth, had been seen as a rising player in reducing bottlenecks for large-scale training models. Mainstream coverage treats the move as a win-win: Nvidia gains expertise, Enfabrica talent gets resources, and the AI industry accelerates. Analysts applaud Jensen Huang’s aggressiveness, calling it a “smart hedge” against rivals like Google, Meta, and AMD.

Oppositional Argument: what this really means

The Nvidia Enfabrica acquisition is not about innovation — it is about domination. Nvidia already controls over 80% of the global GPU market used for AI. By swallowing Enfabrica’s breakthroughs and leadership, it eliminates a potential competitor before it fully matures. What mainstream media sells as synergy looks more like a pre-emptive strike to secure monopoly power in AI hardware. This is not a partnership; it is a buyout of resistance.

Analytical Breakdown: causes and consequences

The deal exposes two realities. First, the AI gold rush has turned into an arms race where capital buys innovation outright. Enfabrica’s potential to democratize networking for AI workloads is now locked inside Nvidia’s fortress. Second, it reveals regulatory weakness. Antitrust watchdogs have barely responded to Nvidia’s string of acquisitions — Mellanox, Arm (attempted), and now Enfabrica. Each move reinforces vertical integration: chips, networking, software, and talent under one roof. The consequence is dangerous: one company sets the pace of AI progress while everyone else rents access.

Human Perspective: what it means for the rest of us

To the public, these corporate maneuvers feel abstract. But they matter. Every time Nvidia absorbs a startup, the dream of a competitive AI market shrinks. Researchers, startups, and even universities will depend more on Nvidia’s closed ecosystem. Prices for GPUs and AI services rise, innovation slows, and the barrier for entry becomes insurmountable. The human cost is not visible yet, but it will be — fewer choices, higher costs, and a future where AI is shaped by the interests of a single corporate boardroom.

Counterarguments

Defenders of the deal argue that without Nvidia’s resources, Enfabrica would never scale. They claim the acquisition accelerates progress and ensures stability in a cutthroat industry. But that logic only works if innovation is shared. Instead, Nvidia locks it down, setting licensing terms and extracting rents. Progress for one company is not progress for society. The argument that “big deals speed innovation” collapses when monopoly power silences competition.

Conclusion: a warning disguised as progress

The Nvidia Enfabrica acquisition is not a triumph of vision — it is a warning. $900 million did not just buy a CEO and a technology license. It bought silence, eliminated a rival, and tightened the noose on AI’s future diversity. Regulators may celebrate short-term growth, but they ignore the long-term price: innovation centralized in one corporate empire. This is not acceleration. It is enclosure. And the cost will be paid by all who are forced to live in Nvidia’s AI world.

External Links

156 views