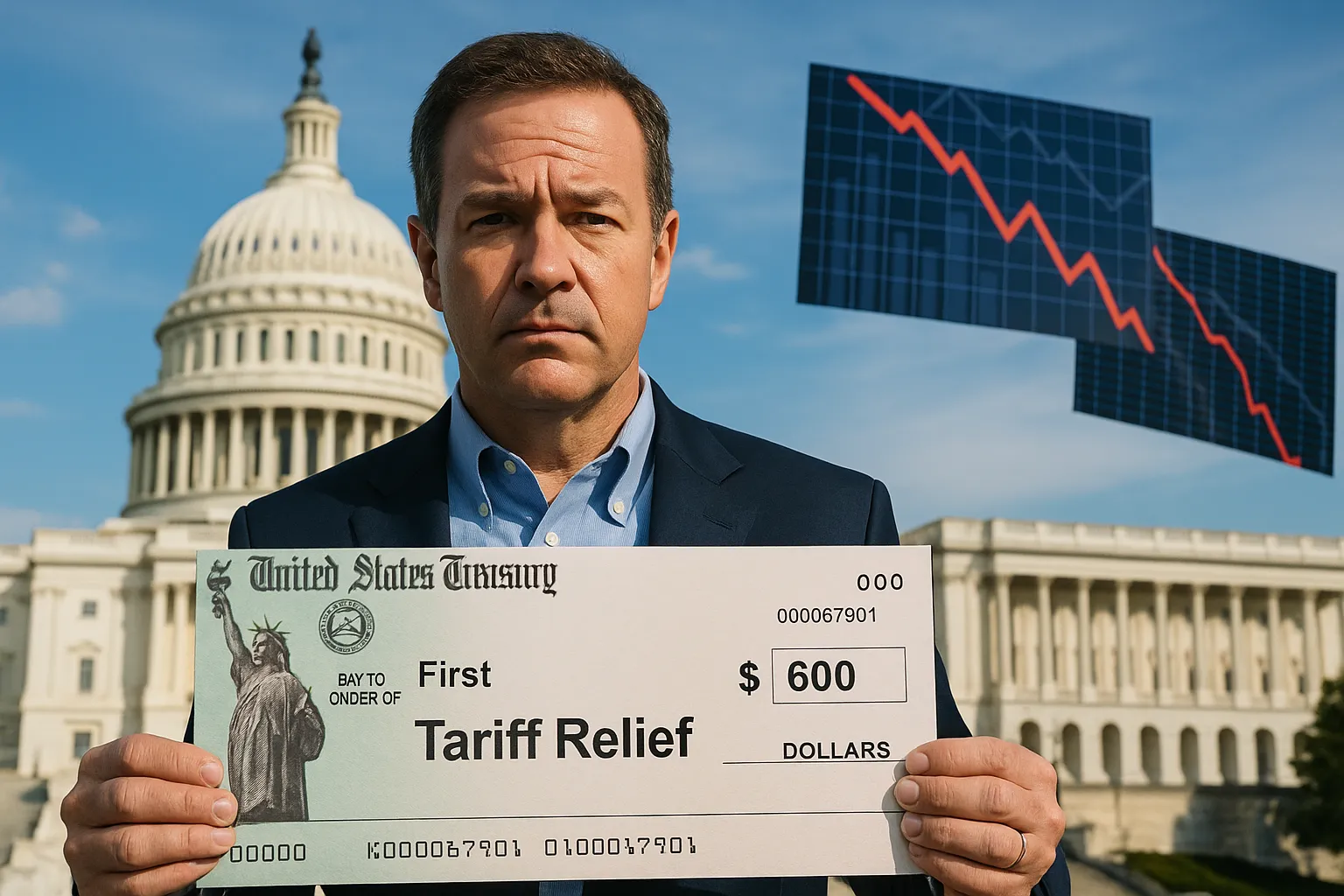

The idea of US tariff checks is gaining traction. Policymakers float a plan to hand out $600 per person to ease the pain of tariffs and keep consumer spending alive. On paper, it looks generous. In reality, it is reckless. Stimulus at this stage of debt crisis risks destabilizing not just the bond market but the very fiscal credibility of the United States.

Context: the plan to cushion tariffs

The Trump administration has made tariffs a cornerstone of its economic model. Imports are taxed, foreign suppliers punished, and prices rise. Consumers complain, industries adjust, and inflation ticks higher. To calm voters, Washington considers direct “tariff checks” — essentially rebates — so households keep spending.

The mainstream spin is obvious: tariffs without pain. A trade war wrapped in candy.

Oppositional argument: stimulus is not free

I reject the idea that checks solve anything. They are fiscal sugar highs. Consumers spend, GDP looks healthy for a quarter, and politicians claim success. But the cost is staggering.

The US is already $37 trillion in debt. Fitch warns that by 2027, debt-to-GDP will surpass 127%. Adding more checks means borrowing more. Borrowing more means selling more Treasuries. And bond markets are already nervous.

This is not relief. It is fiscal self-sabotage.

Analytical breakdown: winners and losers

- Winners: Politicians buying time, corporations selling consumer goods, and households enjoying short-term cash.

- Losers: Bond investors facing higher yields, future taxpayers saddled with repayment, and the credibility of US fiscal discipline.

Even the supposed winners lose later. Households that receive $600 today will face higher interest rates tomorrow.

Human perspective: the illusion of help

Imagine a family of four receiving $2,400 in checks. Relief, yes. But prices remain inflated by tariffs. Rent and healthcare costs rise. Debt repayments eat income. By Christmas, the money is gone. The bills remain.

This is the cruel irony. Relief without reform simply delays the pain.

Counterarguments and their emptiness

Supporters argue checks keep consumption alive. True, but at what price? They say it prevents recession. Maybe — but at the cost of fueling future instability. Others argue it is temporary. Nothing in Washington is temporary once it becomes politically popular.

Checks become votes. Votes become policy. Policy becomes debt.

Conclusion: America cannot buy its way out

The US tariff checks proposal is not protection. It is poison. America cannot print and borrow its way out of every crisis. Stimulus without strategy is suicide.

If Washington continues down this path, the bond market will rebel, debt costs will soar, and the illusion of resilience will vanish. The real check will come due — and it will be paid not in dollars, but in credibility lost.

External references: MarketWatch analysis, Reuters Fitch report.

156 views