Russia attacks Ukraine again with brutal intensity — 143 strikes in one day, new villages lost, civilians suffering. Yet while the battlefield bleeds, Wall Street smiles. Jerome Powell hints at rate cuts, and suddenly investors are euphoric. The contrast is obscene.

Context: the war deepens

Ukraine’s eastern front is under constant fire. Reports confirm that Russia launched more than one hundred strikes across multiple regions, with fresh territorial gains in Donetsk. In Kursk, a drone attack even hit a nuclear plant, forcing output to drop to half. Casualties rise, displacement grows, and the frontline is collapsing under relentless pressure.

This is the reality on the ground. But outside Ukraine, the story takes a surreal twist.

The surreal reaction of markets

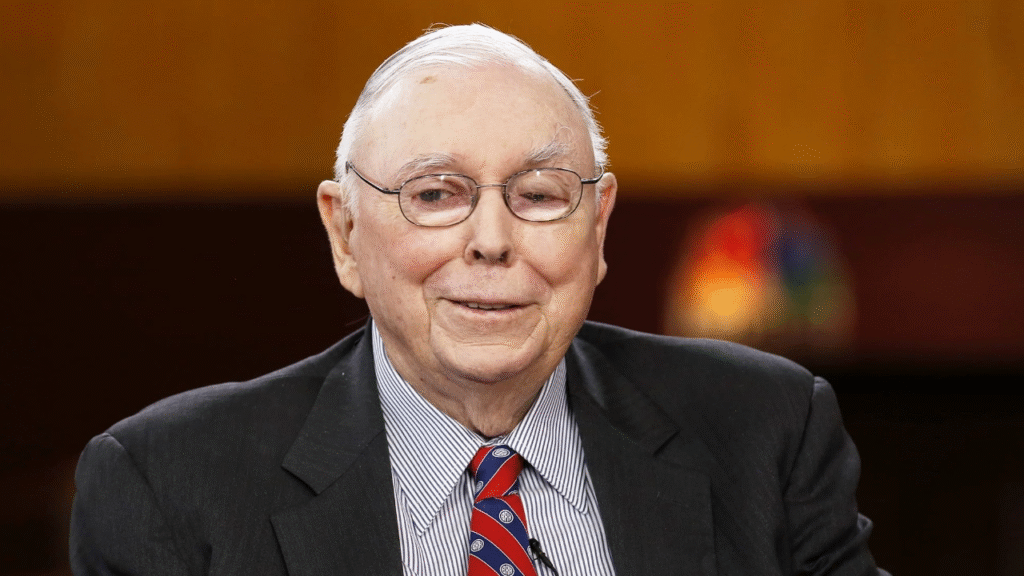

As the war escalates, Jerome Powell spoke in Jackson Hole and signaled possible rate cuts in September. Markets immediately jumped. Dow Jones up. Nasdaq soaring. Bonds retreat, the dollar weaker. The mainstream financial press celebrated it like a festival. Investors cheer while Ukrainians bury their dead.

How is it possible that the same world processes these two realities at once? War in Europe and Wall Street optimism. It is grotesque.

Oppositional argument: markets ignore morality

The West claims solidarity with Ukraine. Leaders issue big words about defending democracy. Yet capital behaves differently. Capital is blind to bombs. Investors calculate profit, not lives. That’s why Russia can attack 143 targets in Ukraine and the next morning traders smile at their screens.

Western hesitation only strengthens this disconnect. Leaders talk of sanctions, but their economies still feed Russia indirectly. As long as markets prosper, real solidarity remains fiction.

Analytical breakdown: Fed versus the frontlines

The Federal Reserve hints at easing, and money moves faster than missiles. Rate cuts might boost consumption, lift stocks, and weaken inflation pressure. But the war shows another side: Ukraine depends on arms, aid, and political will. The contrast highlights the imbalance of priorities — billions are secured for investors while Ukraine begs for ammunition.

The same United States that fuels Wall Street optimism struggles to sustain military support for Kyiv. Europe too counts losses, balancing its budgets more than Ukrainian lives.

Human perspective: lives ignored

In Pokrovsk, in Kyiv, in countless villages, families hide in basements as missiles strike. Children lose parents, parents lose children. But those stories rarely cross into financial news. For the markets, Ukraine is a side note. For Ukrainians, it is everything.

Counterarguments and their emptiness

Some argue: markets and war are separate spheres. But they are not. The flow of capital dictates foreign policy. If war truly threatened profit, sanctions would be immediate and absolute. The fact that investors can celebrate while Russia bombs proves that profit trumps principle.

Conclusion: war versus Wall Street

This is the grotesque reality of our era: war on one side, markets on the other. Russia attacks Ukraine relentlessly, while Wall Street cheers Jerome Powell. What does this say about the moral core of the West? That democracy is secondary, as long as the stock index is green.

And the question remains: how long can Ukraine survive when Western solidarity is measured in stock points rather than lives?

External references: Independent report, Guardian coverage.

174 views